Scott Fitzpatrick:

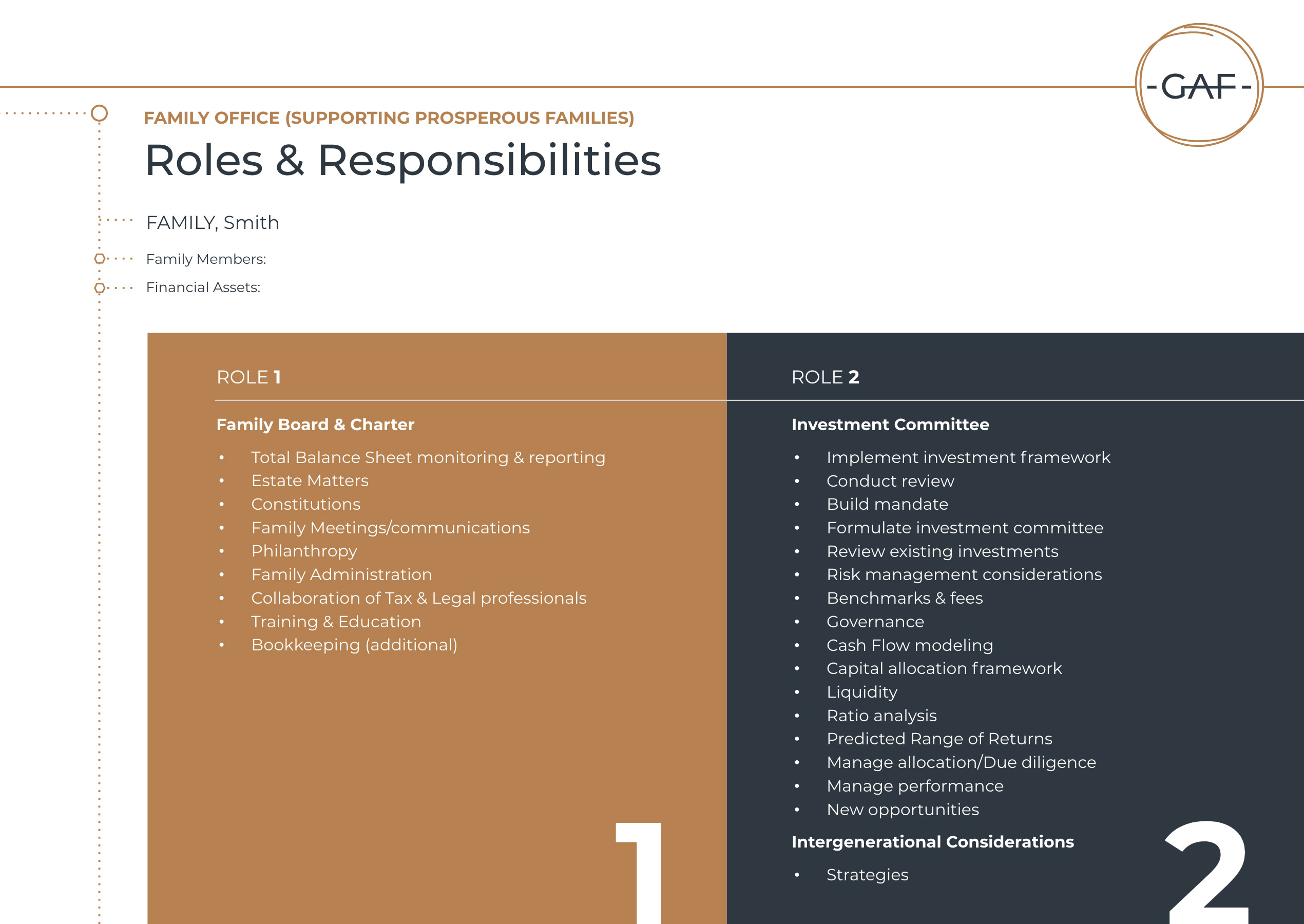

Hi folks. Let’s talk about the role of the advisor for the successful family high net wealth business client. The role starts with understanding point A to point B. So where’s the client up to now, point A? Where are we trying to get them to, point B? Now is it the role, with me as the advisor, to get you from point A to point B with the least amount of risk and the highest degree of predictability? So I use this document or collateral to help me articulate to clients the value that I bring to the equation that helps them visualize this concept of family board or me sitting on their family board being their risk manager. I find it an invaluable document.

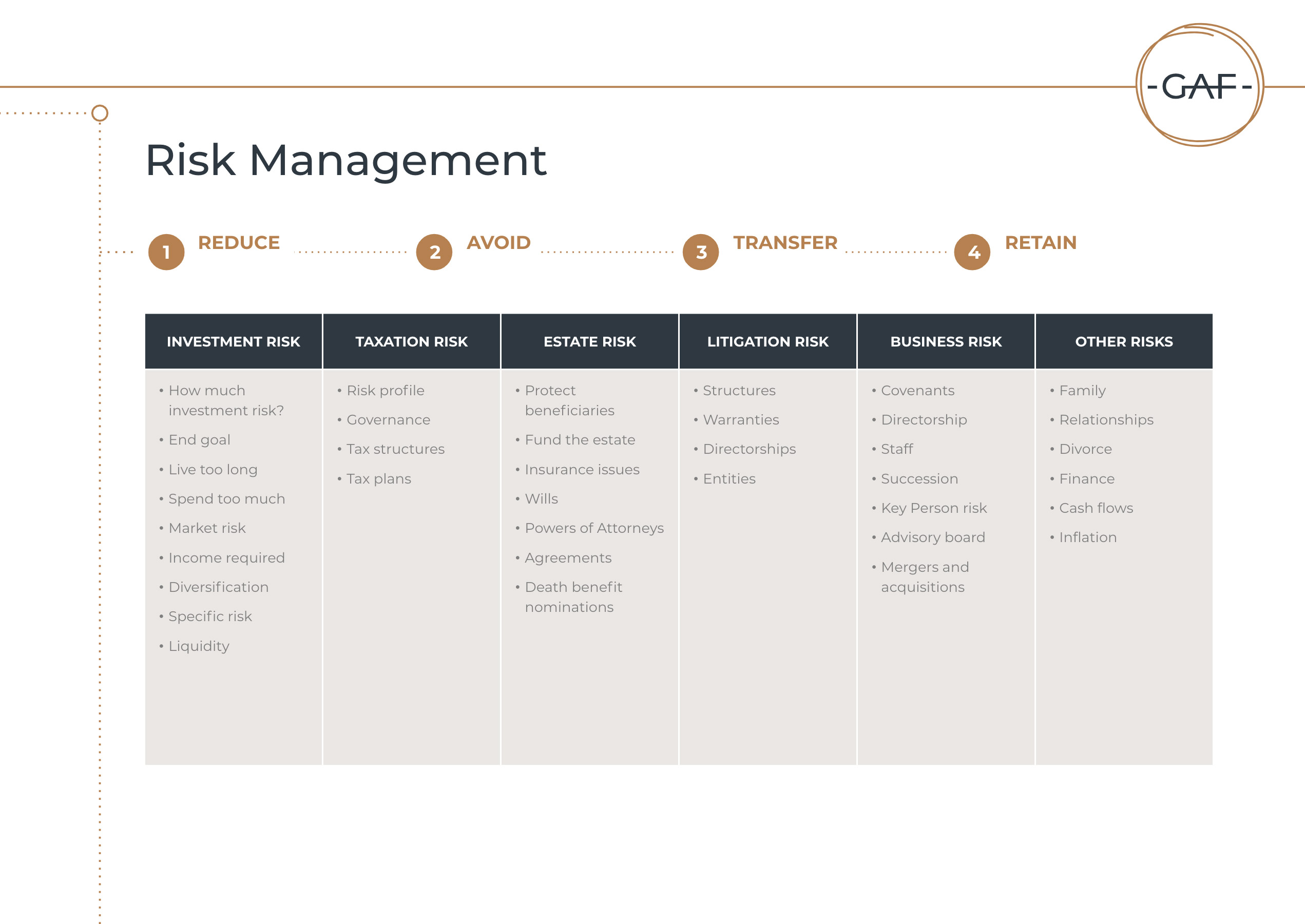

So let’s look at those risks that we face as a client.

Investment risk. How much risk do we take on? Do we live too long? Do we die too early? What’s our liquidity position? Where should we be invested? What return do we need to get?

Let’s look at the taxation risk. Where is our tax profile? Are we tax efficient? What do our structures look like? Are we prepared for tax?

Let’s look at our estate risk. If I died, my wife dies, what do I want for my children? Have I got enough insurance to fund my wills? Do I need a family constitution? What will my legacy be?

Under legal, can I be challenged today? Are my structures watertight?

Asset protection. What are the business risks that I face in there?

Over onto the legal side. Let’s look at them. Once again, business risk, people risk, credit risk.

Under other (heading), people, family relationships, human capital, divorce. Who’s going to help me pull all this together? And this is really the essence of wealth advisory is somebody who can sit across this with me and my family. Because what we need to do with these risks, we either need to reduce them, we need to avoid them, we need to transfer them, or we need to retain them. And for me to project manage all of these risks, I need a Best of Breed team below me. I need the right accountants. I need the right lawyers. I need the right fund managers, etc.

I come back to my starting premise though. This is the role of an advisor – to be a clients risk manager, to understand where they’re trying to get to from point A to point B and then to help manage their risks or help manage their total balance sheet, which includes people.

Resources

Tasks

Activity Summary

0 of 1 questions completed

Questions:

- 1

Information

You have already completed the activity before. Hence you can not start it again.

Activity is loading…

You must sign in or sign up to start the activity.

You must first complete the following:

Results

Results

Time has elapsed

Categories

- Not categorized 0%

-

Great job! Let’s continue the leadership journey with more stories and leadership frameworks…

- 1

- Answered

- Review

-

Question 1 of 1

1. Question

I have watched, understood & actioned the video