Scott Fitzpatrick:

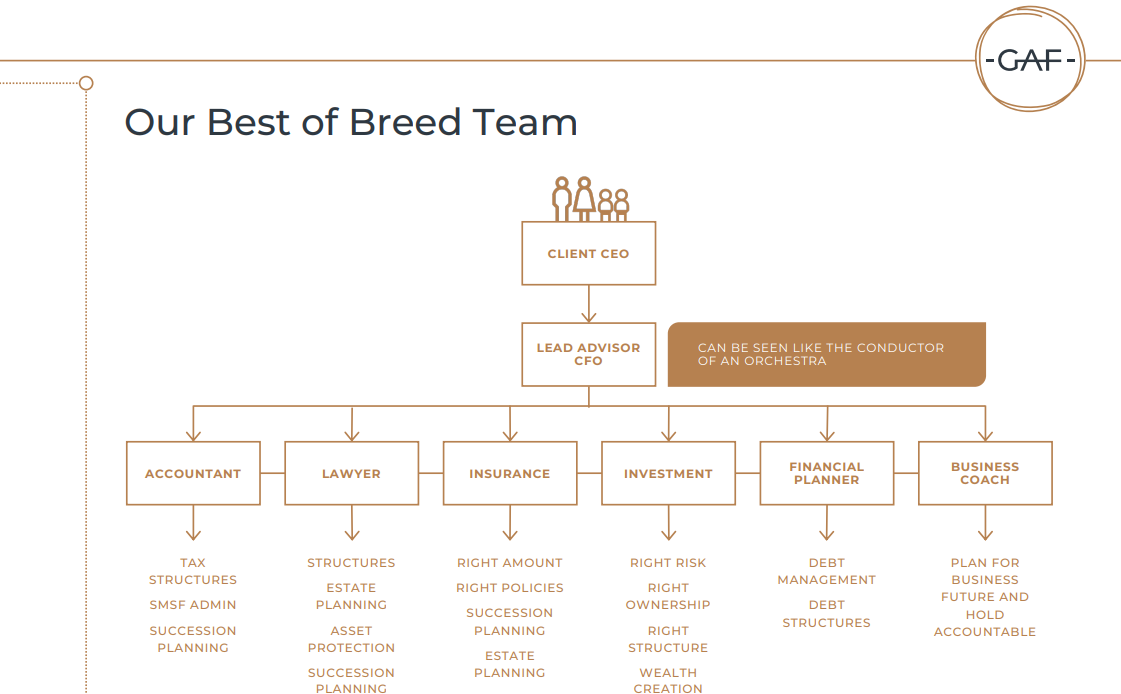

Just a little bit of background to how I think about advising in the Family Board space and the thinking behind it: Imagine you’re sitting up here as the advisor with the Family Board role, the Risk Manager for the family, and you’re overseeing a whole bunch of these risks. What are these risks? Well, we’ve got estate risk, we’ve got asset protection risk, there’s legal issues,there’s tax issues, there’s investment, there’s strategy, there’s guarantees, warranties. There’s a wide range of lists. What we need to be able to do is to engage with the subject matter experts.

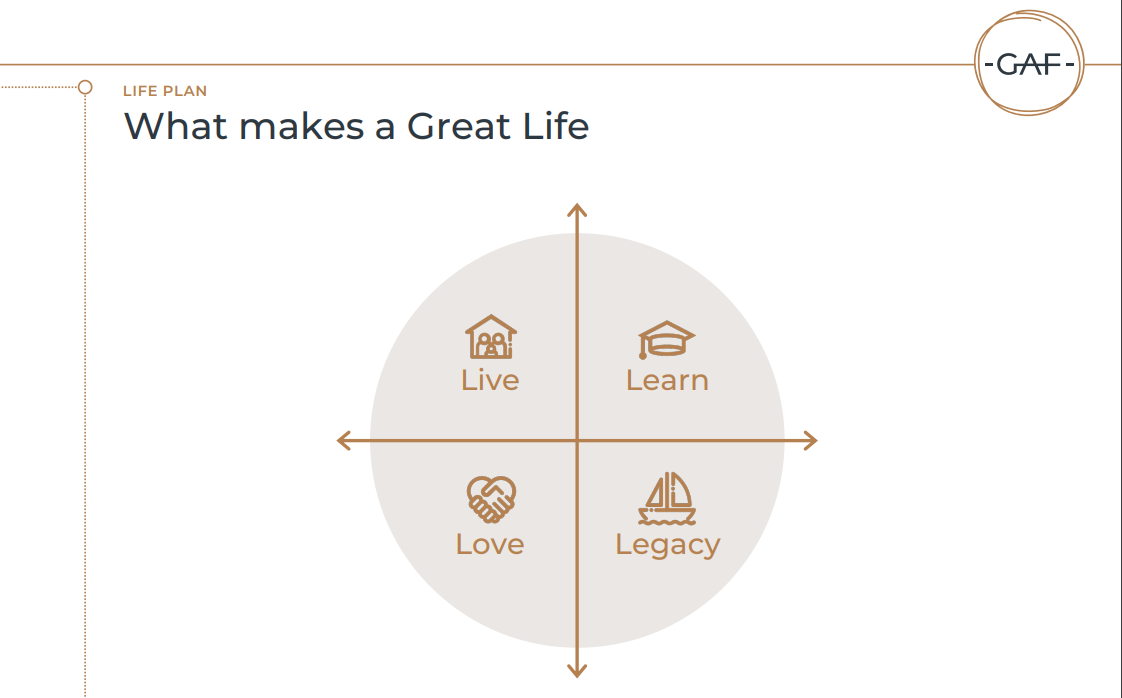

In the estate, it could be the legal, asset protection – legal, maybe a little bit of legal in tax and investment. With the accountants, they’ll have some input here (estate), maybe some input here (legal), input here (investment). There’s a wide range of professionals that we need to be able to engage with, subject matter experts. Even those in wealth management may come from a subject matter expertise of investment or insurance. The skillset used to be able to elevate the conversation around being the project manager to pull all this together for a client within a context about what makes a great life for them. You’ve seen as you use the four Ls: Live, Love, Learn, and Legacy to help tease out what makes a great life for a client.

The family board role is really a contextual role to help the family articulate their values, where they’d like to be as a family group. Your role as an advisor, whether you’re coming from a wealth management, accounting, or legal space, is to be able to elevate, not get stuck in the detail. Be across the detail, but not in it. But you will pull together the Best of Breed Team to deliver the result for the client.

The skill sets here are listening skills, context skills. Staying in context is a skill. As professionals, we all want to get dragged into the content and solution. It’s a coaching role to be able to coach out for clients where they want to be in 10 years. Then, certainly, there’s an advisor role here. We want you to be a financial advisor, not a financial suggester. But that is not the start point. The start point is this coaching or mentoring role to get the family clear about where they’re trying to get to. Your job is to help them project manage a lot of the content to give them the highest degree of probability of achieving that success. It’s a great role. It’s all retainer-based. At the end of each 12 months, we sit down again. “Great. Did you like that? Would you like more of that, Mr. Client?”

Resources

Tasks

Activity Summary

0 of 1 questions completed

Questions:

- 1

Information

You have already completed the activity before. Hence you can not start it again.

Activity is loading…

You must sign in or sign up to start the activity.

You must first complete the following:

Results

Results

Time has elapsed

Categories

- Not categorized 0%

- 1

- Answered

- Review

-

Question 1 of 1

1. Question

I have watched, understood & actioned the video